Insular Health Care, Inc. (IHCI) is one of the top ten Health Maintenance Organizations (HMOs) in the Philippines in terms of capitalization, comprehensive healthcare packages, and service delivery.

IHCI offers one of the industry’s most comprehensive healthcare programs in the market with the flexibility to meet specific needs of its members. As of end of 2017, it has a provider network of 2,868 hospitals, outpatient facilities, and dental clinics nationwide and 28,886 doctors and medical specialists.

IHCI maintains a dynamic website with an online application, a rate calculator that computes membership fees for individual and family accounts, and payment facilities. Also available in the website are the on-going sales promos, Body Mass Index (BMI) calculator, medical articles and agent application Insular Health Care facility. IHCI also utilizes Short Messaging System broadcast facility and email blast to communicate with members. It is also active in the different social media platforms such as Facebook, Instagram, Twitter and LinkedIn.

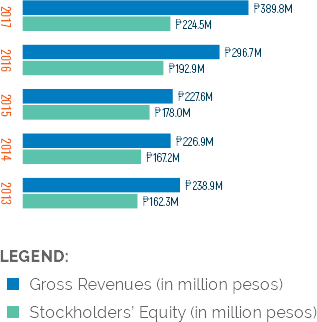

IHCI has embarked into a new system development initiative called ISystem. It’s an integrated end-to-end process automation that aims to complement the growing volume of membership and reinforce the service delivery level of the company. This translates to more efficient and expeditious transactions and even provides more online services such as corporate account franchising, channel accreditation, etc. As of end of 2017, IHCI registered a 31% growth in gross revenues and 24% increase in membership base versus end of 2016.

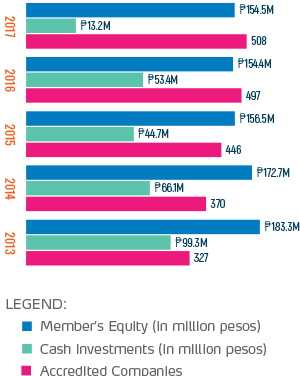

Home Credit Mutual Building and Loan Association Inc., (Insular Home Credit) is a wholly-owned subsidiary of Insular Life that primarily assists its members in availing affordable and low cost housing. In addition, Insular Home Credit offers a high yielding disciplined savings program for its members with the additional benefit of quick access to multi-purpose loans.

In 2017 Insular Home Credit continued its growth in mortgage lending for first time homeowners, more than doubling the prior year’s mortgage receivables. IHC is presently committed to serving all of its members, with exemplary customer service on all its services offered.

MAPFRE INSULAR is a leading non-life insurer in the country and ranks among the top 10 in terms of earned premiums, net premiums written and investment income. The company is also one the highest capitalized and most solvent non-life insurer in the country. The company was formed out of the alliance between MAPFRE, a leading insurance company in Spain with more than 37 million clients worldwide and business activity in more than 100 countries and Insular Life Assurance Co., Ltd, the Philippines’ largest Filipino-owned life insurer.

MAPFRE INSULAR continued to advance its efforts towards comprehensive transformation pioneered in 2015. The company remained in position on achieving sustainable growth guided by the hallmarks of solvency, integrity, innovation, and exceptional quality of service that are the standard in the global MAPFRE Group.

In 2017, MAPFRE INSULAR carried out significant changes in its operations and administration. The company ventured into the creation of its affinity channel and adopted the MAPFRE global business model: Delegado and Direct Office. These efforts helped the company post a modest growth of 1.1% in sales or ₱2.238 billion gross premiums written in 2017.

The company maintained adherence to MAPFRE values in achieving its objective, continually invested in technology, tightened technical controls, and augmented people skills. These directed the company to turn back from risky practices while promoting welfare of the customers. The Operations group implemented centralized claims handling, reinforced fraud prevention through creation of a dedicated unit and definition of business rules, concentrated repair shops in strategic locations, augmented skills of technical people through series of trainings.

Furthermore, MAPFRE INSULAR sustained its investment portfolio management and generated investment income of ₱131.4 million for the year, a 5% growth from 2016. Consolidated efforts from MAPFRE INSULAR’s commercial, operations and administration contributed to a recorded Net Income of ₱11.8 million.

Key unaudited financial and solvency indicators that demonstrate the strength of MAPFRE INSULAR as one of the most relevant insurance companies in the country: