Insular Life’s dynamic corporate culture is guided by its strong corporate governance framework. This framework ensures that the Company’s strategy in achieving its corporate objectives is aligned with the interests of its Stakeholders.

The Company fully complies with the corporate governance principles as embodied in our Manual on Corporate Governance (MCG) and Code of Conduct. These Codes are aligned with the corporate governance principles as enunciated in the Insurance Commission’s (IC) Corporate Governance Principles and Leading Practices (CGPLP), ASEAN Corporate Governance Scorecard (ACGS) and other internationally accepted corporate governance practices. We also benchmark with the best corporate governance practices in other companies in the financial sector.

In 2017, the Company was recognized by the Insurance Commission and the Institute of Corporate Directors (ICD) as one of the Top Insurance Companies in the 2017 ASEAN Corporate Governance Scorecard (ACGS). We took a great stride in improving our corporate governance practices as the result of our ACGS assessment increased by fourteen (14) points to 93.47 points. The ACGS, which is the important tool in assessing corporate governance practices of companies, provides standards reflecting principles espoused by the Organization for Economic Cooperation and Development (OECD).

A detailed disclosure of the Company’s corporate governance practices in 2017 is discussed below.

RIGHTS OF OUR MEMBERS

Insular Life is a non-stock, mutual life insurance company. In lieu of stockholders, we have Policyholder-Members (“Members”) who are owners of the Company. The Company upholds and respects the rights of all Members as provided in the Amended Insurance Code, the Corporation Code, other pertinent laws, rules and regulations, the Company’s Articles of Incorporation, By-Laws, and Manual on Corporate Governance (MCG).

Members have the right to be notified of any regular or special Members’ Meeting. In 2017, the Notice of the Annual Members’ Meeting (AMM) was published once a week for four (4) consecutive weeks starting 26 April 2017 (or 28 days before the date of the AMM) in The Philippine Star and Pilipino Star NGAYON. It was simultaneously published in the Company website.

Members also have a right to nominate candidates for the Board of Trustees. They may do so in writing and have it delivered to the Board of Trustees on or before the fourth Wednesday of January immediately preceding the AMM.

During the Members’ Meeting, each Member is entitled to one (1) vote, regardless of the number of policies he owns or the amount of insurance that he holds. Each Member has the right to elect Trustees or members of the Board individually. This right to vote may be exercised in person or in absentia through the use of a duly executed proxy form.

Each Member has a right to be informed of the condition of the Company, of the current members of the Board and Management, its corporate objectives and other relevant information. Each Member also has an opportunity to ask questions or raise issues during the Meeting and to address their concern directly to the Trustees and Management.

2017 Annual Members’ Meeting (AMM)

The 2017 AMM was held on Wednesday, 24 May 2017 at 4:15 PM at the Company’s principal office and easy to reach location, Insular Life Corporate Centre Auditorium, Filinvest Corporate City, Alabang in Muntinlupa City.

The registration started at 09:00 AM and ended at 04:00 PM. All registered Members received a Policyholder Kit containing updated information about the Company, including the latest Annual Report. An electronic system facilitated the registration and voting process.

All nine (9) members of the Board of Trustees (including the CEO-Trustee and Chairpersons of each Board Committees) were present during the AMM and were presided by Independent, Non-executive Chairman of the Board, Mr. Luis C. la Ó.

All agenda items in the Notice were taken up by the Chairman and upon proper motion, were approved. The Trustees replacing those whose terms have expired were elected individually by the Members during the Meeting.

Resolutions adopted for each agenda item were known on the floor after it was carried. There was no bundling of several items in each resolution. A summary of all the resolutions adopted during the AMM, as well as the results on votes by poll, were published in the Company website on 25 May 2017, or one (1) day after the AMM.

The Company’s Corporate Secretary documented the conduct of the Meeting in the Minutes of the AMM (“Minutes”). The 2017 Minutes includes the following: rules of the meeting; the voting and voting tabulation procedures; list of Trustees and Senior Officers who were in attendance during the Meeting; identification of the name of the Company’s External Auditor seeking appointment or re-appointment; summary of resolutions adopted including results of the votes; opportunity for Members and other attendees to inquire or raise their concerns; and record of responses to the questions, and comments raised in the floor during the Meeting. A copy of the latest Minutes is available in the Company website.

The Company recognizes the right of our Members to participate in decision-making concerning fundamental changes in the Company. Examples of such fundamental change could be mergers, acquisitions, and/or takeover requiring Members’ approval, where the Board shall appoint an independent party to evaluate the fairness of all aspects of the transaction, including its transaction price.

Disclosure and Release of the Notice of the 2017 AMM

The Company encourages all Members to attend all Members’ meetings, whether regular or special. The Notice of

the 2017 AMM (“Notice”), which was published in English, beginning 26 April 2017 and with no bundled agenda

items, provides the following information:

- Details and rationale of each of the Agenda, including identification of Sycip, Gorres Velayo and Company as the

External Auditor seeking re-appointment and proposed resolutions for Agenda items;

- Voting and vote tabulation procedures;

- A summary of acts and resolutions approved by the Board and the Executive Board Committee since the date of last Members’ meeting;

- Profiles of Trustees for election/re-election (including age, academic qualifications, date of first appointment, experience,

and directorships in listed and non-listed companies); and

- Proxy form.

The Notice ensures that Members and other Stakeholders are equipped with all the relevant information about the meeting before

the AMM is conducted. The Company also facilitates participation of Members who cannot attend the meeting by enclosing

a proxy form in the Notice.

STAKEHOLDER RELATIONS

An essential part of our corporate governance framework is taking care of our Customers, Employees, Agents, Suppliers, Contractors, and the community (“Stakeholders”). We see them as our partners in the achievement of our goals and that is why we strive to provide avenues for their well-being, growth, and protection.

Members’ and Customers’ Welfare

Our mission statement stipulates that we provide a full range of high-value insurance products and other related services that empower families to attain financial security and fulfill their dreams, thus helping build a stronger Philippines. We enable our professional customer-oriented employee and agency force to render service of highest quality. We operate with excellence at all times to optimize Stakeholder value and continuously pursue strategic opportunities to achieve sustained growth. In 2017, we 1) launched financial literacy gameplay; 2) implemented an end-to-end policy servicing in the Company’s Customer Portal; 3) conducted Annual Members’ Meeting; and 4) expanded the Company’s E-Commerce platform.

Filipino Sheroes

The Company partnered with the International Finance Corporation (IFC), a member of the World Bank Group, to educate and offer risk-mitigating solutions to the relatively untapped women segment of the Philippines. We are the only Asian partner of IFC to take on this undertaking to expand the Company’s reach to the uninsured and underserved population of women dubbed as “Filipino Sheroes”.

Agents

Our Sales Agents are our ambassadors in providing full range of high-value insurance products and in rendering service of the highest quality. In this regard, we 1) implemented an automated application and underwriting system; 2) rolled out E-Commerce platform; 3) launched comprehensive Agency training courses; and 4) simplified compensation program.

Suppliers, Contractors, and Third Party Providers

The Company engages, from time to time, the services of Suppliers, Contractors, and other Third Party providers as needed in its operations. For the Company to continue to provide quality products and services, we look for Suppliers, Contractors, and Third Party providers who are competent to render services with the same level of integrity and commitment to corporate governance. It is the policy of the Company that we regularly conduct 1) regular review, selection, and accreditation of Suppliers, Contractors and Third Party providers; 2) participation only of accredited Suppliers, Contractors and Third Party providers in the Company’s bidding process; 3) selection of winning bidder using pre-established set of criteria and 4) disclosure of their related party relationship pursuant to the Company’s Related Party Transactions (RPT) policy.

Employees

Employees are among the most important assets of the Company. The Company promotes a culture where health and safety are integral part of every business decision. To this end, it is the policy of the Company to promote employee health, safety, and welfare. Some of the activities we provide for our employees include provision for medical and dental facilities; employee sport tournament; organize fitness and cultural upliftment classes; periodic townhall meetings; weekly publishing of Insular Life newsletter; launch of digital attendance management system; innovation session; regular health bulletins; and involvement in regular earthquake and fire drills. Other activities and information about our employees are disclosed in the People and Talent section of this Report.

Creditor’s Rights

It is the policy of the Company to protect our Creditor’s rights. We make sure that we comply with all regulatory requirements on capitalization, Risk-Based Capital framework (RBC 2), solvency, liquidity, and other similar requirements. Also, for purposes of transparency, the true financial condition of the Company is timely and fully disclosed through quarterly reports to the Insurance Commission (IC) and submission of annual Audited Financial Statements (AFS) to the Securities and Exchange Commission (SEC). We upload the Company’s AFS in our website.

Currently, the Company has no Creditor. In the event that we enter into a loan agreement where the Company is a Borrower, the same shall be referred to the Board for approval. All our legal obligations and commitments under the loan agreement shall be monitored and complied with, subject to regulatory requirements.

As a Creditor, we conduct proper screening of prospective borrowers, accurate and complete loan documentation, accurate and complete recording of loan repayments, and observance of legal and regulatory reporting on the same. We conduct collection activities without abuses and deceptive practices while enforcing our rights.

Community and Environment

It is the Company’s policy to conduct its business in a sustainable and environment-friendly way. In 2017, we implemented a paperless insurance application and underwriting system, we unveiled a newly-renovated Leadership in Energy and Environmental Design (LEED) - certified building, we participated in 2017 World Bamboo Day and sponsored disaster-resilient classrooms. Other activities and information are disclosed in the Corporate Social Responsibility section of this report.

Anti-Corruption Programs and Procedures

The Company’s Anti- Corruption Program is embodied in the following policies:

Code of Conduct and Manual on Corporate Governance

The Company’s core code of ethics is embedded in two principal documents - the Manual on Corporate Governance, and

the Code of Conduct - which Trustees and employees comply with. Their compliance to these documents is measured

as part of their respective annual performance appraisals. As part of Insular Life, they must comply with applicable

laws, rules and Company policies. All Trustees and employees are also required to disclose any potential or actual conflict

of interest, as well as Related Party relationships in transactions with the Company. Compliance to these documents is

included in their respective annual performance assessments.

Anti-Corruption Policy

The Company has an Anti-corruption Policy that expresses strict prohibition of any business engagement that may tarnish our

reputation, including especially an act constituting bribery or corruption:

Expanded Whistleblowing Policy

Any concerns and/or complaints about possible violation of rights may be reported through any of the Company’s whistleblowing

platforms. The report may be about the organization, its people, and its operations. Those who report to the Company

in good faith of a suspected violation of law (including bribery or corruption, fraud) or breach of Company policy are

protected from any form of retaliation.

Reports or concerns from stakeholders or the public may be addressed to the Company’s Compliance Officer, Atty.

Renato S. de Jesus, through the following contact information:

In 2017, the Board has approved additional Whistleblowing platforms (i.e., allowing a report to be submitted to the Head

of Internal Audit, establishing a dedicated email address at inlifergovernance@insular.com.ph, and a separate voice mailbox

number). The move was done to provide additional means to accommodate feedback and other reports from other Stakeholders.

The Whistleblower (who may be an employee, Agent, Trustee, Member, Supplier, or other Stakeholder) may keep his or her identity

anonymous. All reports received in good faith shall be kept confidential and will be protected from any form of retaliatory

action, in accordance with the Company’s Whistleblowing Policy.

DISCLOSURE AND TRANSPARENCY

Performance Indicators and Disclosures

| Financial |

Non-Financial |

|

Customer Satisfaction; |

|

Talent Acquisition; |

| Financial Condition; |

Regulatory Compliance; |

| Performance of Fund Values; |

Operational Efficiency; |

|

Corporate Social Responsibility(CSR) capability |

Medium of Communication

The Company practices transparency in disclosing corporate matters affecting Stakeholders. Information relating to corporate

events, programs, and people are timely and accurately reported in the Company website on a quarterly or a more frequent

basis, as may be necessary. These are also published in newspapers of general circulation and other media the Company

may deem appropriate. The Company provides Customer and Agent Portals for Members and Agents, respectively, for easy

and secure access to policy information and services. The Company also utilizes print and visual media, media briefings/press

conferences and social media platforms to ensure wide public reach of all relevant information.

Key Risks

The Company believes that prudent risk management hinges on effective risk metrics for the proper risk identification and

quantification of our exposure to such risks. To this end, the Company has identified key risks (strategic, operations,

legal and regulatory compliance, reputational, and financial risks) which are carefully studied, defined, and managed.

The Board has the ultimate responsibility for the Company’s risk management and material controls. The Board, through

its various Committees, monitors and evaluates the Company’s total risk management systems and advises Management

in the installation of appropriate control mechanisms. These controls are regularly audited to check their effectiveness

and reliability. The Board reviewed the Company’s internal controls and Risk Management systems and found

the same to be generally sufficient and adequate. The Company’s Risk Management systems are complemented by the

Management and employees’ deep commitment to sustain a dynamic and transparent compliance environment.

Related Party Transactions Policy

The Company’s policy on Related Party Transactions (RPT) ensures that all transactions of the Company with a Related

Party are conducted fairly, at arm’s length, and in the best interest of the Company and its Stakeholders. The

Related Party Transactions Board Committee (“RPT Board Committee”) is composed of all Independent, Non-executive

Trustees. They are tasked to review RPTs that are material in nature. Decisions based on their review are

reported to the Board. The Board ultimately has the responsibility of ensuring that all approved material RPTs are soundly

and prudently managed, with integrity and in compliance with applicable laws, rules, and regulations. Prior to the approval

of the Board on the creation of a separate RPT Board Committee based on the Insurance Commission’s (IC) Circular

Letter No. 2017-29, the Audit & Risk Management Committee (ARMC) handled the review and evaluation of transactions

to ensure that they are conducted fairly, at arm’s length, and in the best interest of the Company and its Stakeholders.

The names, relationship, nature, and value of RPTs for the financial year 2017 are disclosed in the Notes to the Consolidated

Statements (“Notes”) in this Annual Report. There is no RPT that can be classified as financial assistance

to entities other than wholly owned subsidiaries of the Company. In case of Material RPTs, these are reported to the

IC and reflected in the Annual Report.

Conflict of Interest

It is the Company’s policy to ensure that any Trustee or Officer declare potential or actual conflict of interest, and must abstain and/or inhibit themselves from participating in any material discussion or approval of the same. All Trustees and Officers are required to disclose any conflict of interest as part of their respective annual performance assessments.

Timely disclosure of Annual/Financial Reports

The 2016 Annual Report, which also contained the Consolidated Audited Financial Statements was published in the Company website

on 27 April 2017, or one hundred seventeen (117) days after end of financial year.

Dividend Policy

As members of a non-stock mutual life insurance corporation, qualified Policyholders receive policy dividends as return of

their premiums paid. The Company allocates and pays policy dividends, as and when they are declared, and in such amounts

as approved by the Board of Trustees. The amount of policy dividends is determined on the basis of a three-factor formula

which calculates the Company’s performance vis-a-vis assumptions on investment income, mortality, and expense loading,

taking into consideration regulatory requirements and the Company’s capital and future operating needs. The provision

for policy dividends for 2017 is ₱197,393,043.39.

Audit

The Company has an Internal Audit Staff headed by First Vice President, Ms. Maria Rosa Aurora D. Cacanando. The Internal

Audit Staff reviews the Company’s internal control system and has direct reporting line to the Board’s Audit

& Risk Management Committee (ARMC) and to the Chairman of the Board.

To complement internal audit, the Company also availed itself of the services of an External Auditor to ensure independent

review of the Corporation’s Financial Statements.

The ARMC is primarily responsible for the recommendation of the appointment/re-appointment and removal of external auditors.

During the 2017 AMM, SGV was re-appointed as the Company’s External Auditor based on the recommendation of Mr.

Luis Y. Benitez, Jr. as the Chairman of the ARMC.

Audit and Non-Audit Fees

The audit fees paid for SGV’s 2017-2018 services rendered to the Company amounted to ₱3,228,330, excluding out-of-pocket

expenses and Value Added Tax (VAT). The non-audit fees do not exceed the audit fees. In fact, no non-audit service

was performed by SGV in 2017.

Remuneration Matters

Board Compensation Policy and Procedures

Executive Trustees are Members of the Board who are also Executives of the Company. Executive Trustees (including

the Chief Executive Officer) are compensated for their services rendered as such Executives and do not receive any compensation

for their attendance in Board and Board Committee Meetings. The Personnel and Compensation Board Committee is responsible

for reviewing and recommending to the Board the compensation and remuneration packages for Executive Trustees (including

the CEO) and Senior Management (collectively called “Key Management Personnel”). The amount of compensation

received by Key Management Personnel is disclosed in the Notes to the FinNotes to the Financial Statements Section of this Report.

Non-executive Trustees receive an annual compensation of ₱25,000.00 for their membership to the Board and to the Executive

Board Committee. They also receive Per Diem of ₱30,000.00 for each Board and Board Committee meetings that they attend.

The Chairman of the Board receives twice the amount of Per Diem received by a Non-executive Trustee for his attendance

in Board Meetings. The table below summarizes the compensation of each Non-executive Trustee for the year 2017:

| Name of Trustees |

Per Diem Paid (in PHP)

in Board and

Committee Meetings

(from January – December 2017)

|

| NON-EXECUTIVE |

|

| Marietta C. Gorrez |

₱415,000.00 |

| SUB-TOTAL |

₱415,000.00 |

| INDEPENDENT, NON-EXECUTIVE |

|

| Luis Y. Benitez Jr. |

₱745,000.00 |

| Delfin L. Lazaro |

₱680,000.00 |

| Luis C. la Ó (Chairman of the Board) |

₱1,010,000.00 |

| Francisco Ed. Lim |

₱980,000.00 |

| Nico Jose S. Nolledo |

₱415,000.00 |

| SUB-TOTAL |

₱3,830,000.00 |

| GRAND TOTAL |

₱4,245,000.00 |

RESPONSIBILITIES OF THE BOARD

Roles and Responsibilities

A well – governed corporation begins with a well-governed Board. Insular Life’s Board of Trustees

performs its roles and responsibilities diligently for the good of the Company and its Stakeholders. Some of their roles

include:

- To install process of selection of the Board of Trustees and Management;

- To determine and regularly review the purpose, vision, mission, core values, corporate objectives, and specific strategies and implementation or action plans to support the same;

- To identify key performance indicators, and establish performance standards for the monitoring of the attainment of the corporate objectives;

- To identify stakeholders and formulate a clear communication policy;

- To make rules for internal regulations;

- To present a balanced and understandable assessment of the Company’s position and prospects;

- To determine the manner and conditions under which employees may be granted pension retirement, gratuity, life insurance, and other benefits;

- To ensure compliance with all relevant laws, rules, regulations, and codes of best business practices;

- To settle any doubts that may arise relative to the interpretation of the By-Laws and supply any omissions, reporting thereon to the Members’ meeting for such action as it may see fit;

- To properly discharge Board functions through regular and special meetings; and

- To assess its own effectiveness in fulfilling its responsibilities.

Annually, the Board conducts an assessment of its overall performance based on the aforementioned criteria.

The Board’s roles and responsibilities are found in the Company’s By-Laws and Manual on Corporate Governance. These documents are also available in the Company’s website.

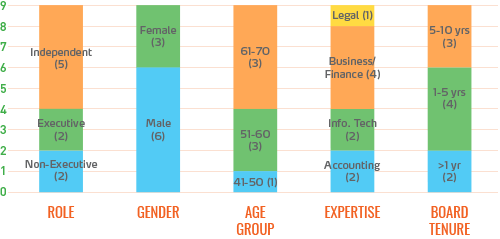

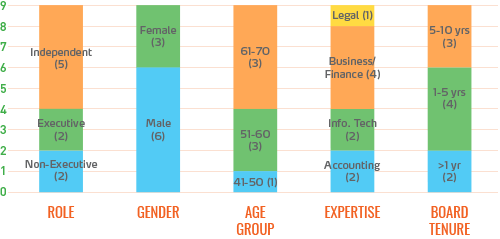

Board Composition and Diversity

The Board of Trustees occupies a crucial role in the Company’s corporate governance framework. Thus, the Company’s

Succession Planning ensures continuity and seamless transition, as provided in the Company’s By-Laws and in the

Manual on Corporate Governance. The Nominations Committee (NomCom) undertakes the process of identifying the qualities

that must be possessed by a candidate which must be aligned with the Company’s strategic directions. The Committee

ensures that all the Trustees possess relevant competence and experience for the Board and Board Committee membership.

The Board is divided into three classes with three (3) Trustees in each class. Each Trustee is elected individually to

serve for a term of three years or until the election and qualification of their successors, in accordance with the Company’s

By-Laws.

Board Selection and Appointment Process

The selection of the Board of Truestees takes into account the following criteria:

1) A member of the Company;

2) A Filipino ciizen;

3) A resident of the Philippines;

4) With qualifications that are aligned with the strategic directions of the Company; and

5) Has none of the prescribed disqualifications enumerated in the Company's By-Laws

Apart from these qualifications, the selection of a Trustee is not restricted to age, race, gender or religious belief. We promote and encourage diversity at all levels of the organization to ensure dynamic conversations and broad spectrum of perspectives and expertise

The Company uses professional search firms and other external sources and public databases when looking for qualified candidates

for the Board, if necessary. In selecting a Trustee, the Company adheres to the provisions of its By-Laws and Manual

of Corporate Governance. The Nominations Committee is tasked to ensure the conduct of the following:

The Board of Trustees

The nine (9) members of the Board of Trustees were elected for their competence, experience, expertise, and unquestionable

integrity. All Trustees are experts in their respective fields and possess all the qualifications as set in the

Company’s By-Laws and the Manual on Corporate Governance (MCG).

All trustees have complied with the fit and proper requirements and corporate governance trainings within the prescribed

timeframe. They are required to disclose to the Corporate Secretary any significant change in their commitments and relationships

outside Insular Life.

Board Independence

The Board has five (5) Independent, Non-executive Trustees who comprise more than fifty percent (50%) of the Board. All of

them are independent of Management and free from any business or other relationships which could materially interfere

with their exercise of independent judgment in carrying out their responsibilities. One of the Independent Trustees,

Mr. Luis Y. Benitez Jr., is a Certified Public Accountant. None of the Independent, Non-executive Trustees occupies more

than five (5) board seats in Publicly Listed Companies (PLCs). In the case of Executive Trustees, none of them occupy

seats in more than two (2) PLCs.

Chairman of the Board

In 2017, the Board of Trustees was led by Independent, Non-executive Chairman of the Board, Mr. Luis C. la Ó.

As an Independent Trustee, he exercises the functions of his office independently from management and is free from any

interest, any business or other relationships that could interfere with his independent judgment. His roles and responsibilities

as Chairman of the Board are stated in the Company’s By-Laws and Manual on Corporate Governance (MCG). His detailed

profile is available under the Credentials Section of this Report.

Orientation for New Trustees

The Board sets the tone of the corporate governance framework of the Company. For the framework to be both effective and

relevant, the Board must constantly be informed of the latest information on corporate governance rules and best practices.

The Chairman of the Board, together with the CEO, President and COO, senior executives and the Corporate Secretary,

conducts an orientation for new Trustees. As part of the orientation program, new Trustees are provided with key corporate

documents and information (i.e., Board Kit) and are briefed about relevant corporate policies and corporate governance

program of the Company.

2017 Corporate Governance Seminar

The Company encourages its Board to attend on-going or continuous professional educational programs. Apart from the individual

trainings and seminars attended by Trustees, the Company also provided an orientation on “Advanced Corporate Governance

Program” on 23 November 2017, with speakers from the Institute of Corporate Directors (ICD). This half-day event

discussed the following: “The Dragonfly perspective” by Mr. Ricardo Jacinto, “Corporate Governance

Regulatory Perspectives” by Mr. Roberto Bascon and “Leading Change and Strategy Focused” by Ms. Ida

Tiongson. The Insular Life Board of Trustees was joined by its senior management and the officers of its Subsidiaries.

Board Committees

The Board has eight (8) Board Committees that are delegated specific roles, responsibilities, and authorities through their

respective Board Charters. These are 1) Executive; 2) Audit and Risk Management; 3) Finance, Budget and Investment; 4)

Governance; 5) Information, Technology, & Innovation; 6) Nominations; 7) Personnel and Compensation and 8) Related

Party Transactions (RPT) Committee. The RPT Committee was formed in 2017 as part of the Company’s RPT Policy pursuant

to the Insurance Commission’s Circular Letter 2017-29.

An annual conduct of performance assessment of each of the Board Committees ensures that they perform to the highest of their

abilities. The criteria for such assessment is measured by their performance of all roles and responsibilities as indicated

in their respective Board Charters. The Board Charters are available in the Manual on Corporate Governance and in the

Company website.

Board Meetings and Attendance

A basic requirement of a responsible Board is the conduct of regular meetings. To ensure that each member has sufficient

knowledge of the Board and Committee agenda, schedules of Board and Committee meetings for the succeeding year is set

before the end of the preceding year. The Corporate Secretary, Atty. Renato S. de Jesus, plays a significant role in

supporting the Board as it discharges its responsibilities. He ensures that the Board is informed of the agenda, including

relevant papers and other documents, five (5) business days before the date of the meeting.

The Non-executive Trustees met during the year to review corporate strategic matters without any of the Executive Trustees

present. Aside from lively discussions during the Board and Board Committee meetings, the Company also provides opportunities

for continuous learning and development for Trustees to keep them abreast of local and international trends and issues.

The trainings and other conferences attended by our Trustees may be found in the Credentials Section of this Report.

Annual Board Performance Assessment

The Office of the Corporate Secretary is responsible for the conduct of an annual performance evaluation of the Board, the

Trustees, and the Board Committees. Each Trustee assesses the performance of the Board as 1) a collegial body, 2) as

an individual member, and 3) as a member of the Board Committees in which they belong. Some of the criteria for assessment

include the accomplishment of the Board of its requisite roles and responsibilities, the judicious and professional conduct

of the Trustees, and the assistance and advisory duties of each Board Committee on matters of its expertise. Aside from

the objective assessments, the Trustees are given opportunities to provide ideas and suggestions on how to further enhance

Board, Committee or their individual performances, and to write the same in the assessment forms. The Board has completed

their annual assessments (i.e., as a collegial body, as a member, and as a Board Committee member) on December 2017.

The Personnel and Compensation Committee reviews and evaluates the performance and appropriate compensation of the President

and CEO, and other senior management. The results of the evaluation are submitted to the Board for their approval. The

results of the assessment demonstrate the Board’s effectiveness and competence and how each Trustee is fully committed

to the achievement of the Company’s mission and vision for the interest of the Stakeholders.