i

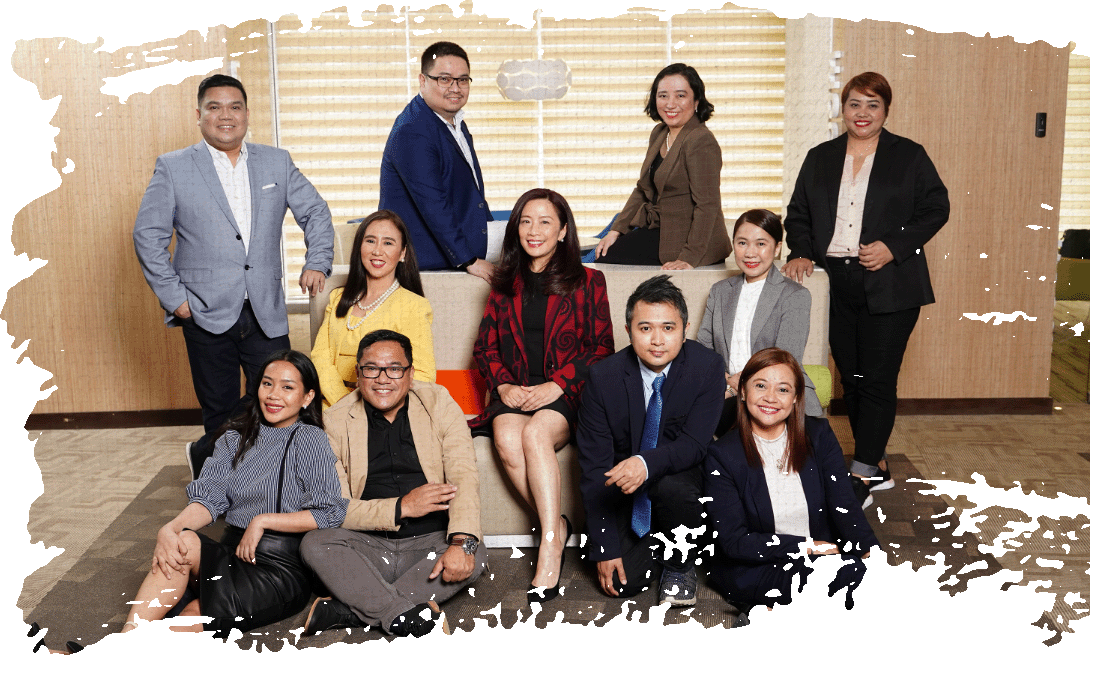

Insular Health Care President and CEO Maria Noemi G. Azura (seated, middle) is flanked by IHC’s high-performing teams and executives. They are (L-R), standing: Geronimo V. Francisco, First Vice President, Chief Risk Officer, Compliance Officer, Chief Actuary & Head of Risk & Compliance, Dr. Mark Roland F. Malanay, Vice President, Head of Medical & Provider Services Division, Myra T. Santos, Asst. Vice President, CFO & Head of Finance Operations, and Jocelyn C. Geronimo, Hospital Liaison Officer. Seated, (L-R): Tricci Rose A. Sadian, First Vice President, Head of Marketing & Sales Division, Ms. Azura, and Chriselle Ines, Direct Sales and Affinity Markets Head. On the floor are, (L-R): Rhanniel Baldago, Marketing and E-Commerce Head, Rogie P. Nino, DIT Senior Asst. Vice President, Integrated Technology Services Division Head, Don Kristoffer D. San Diego, Medical Support Center Head, and Sheila Marie D. Iglesia, Senior Asst. Vice President, Human Resources & Customer Experience Head.

Previous page

Previous page