- Message of the Executive Chairperson

- Report of the President & CEO

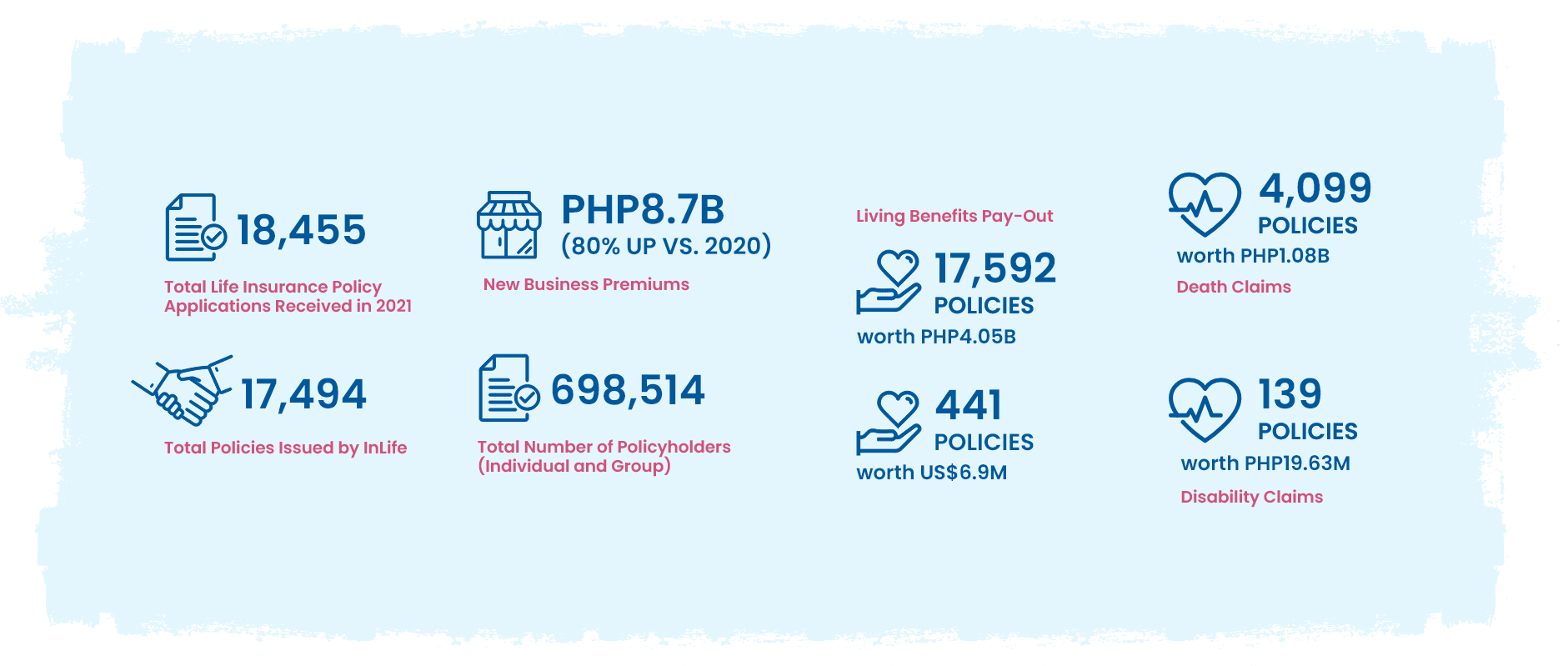

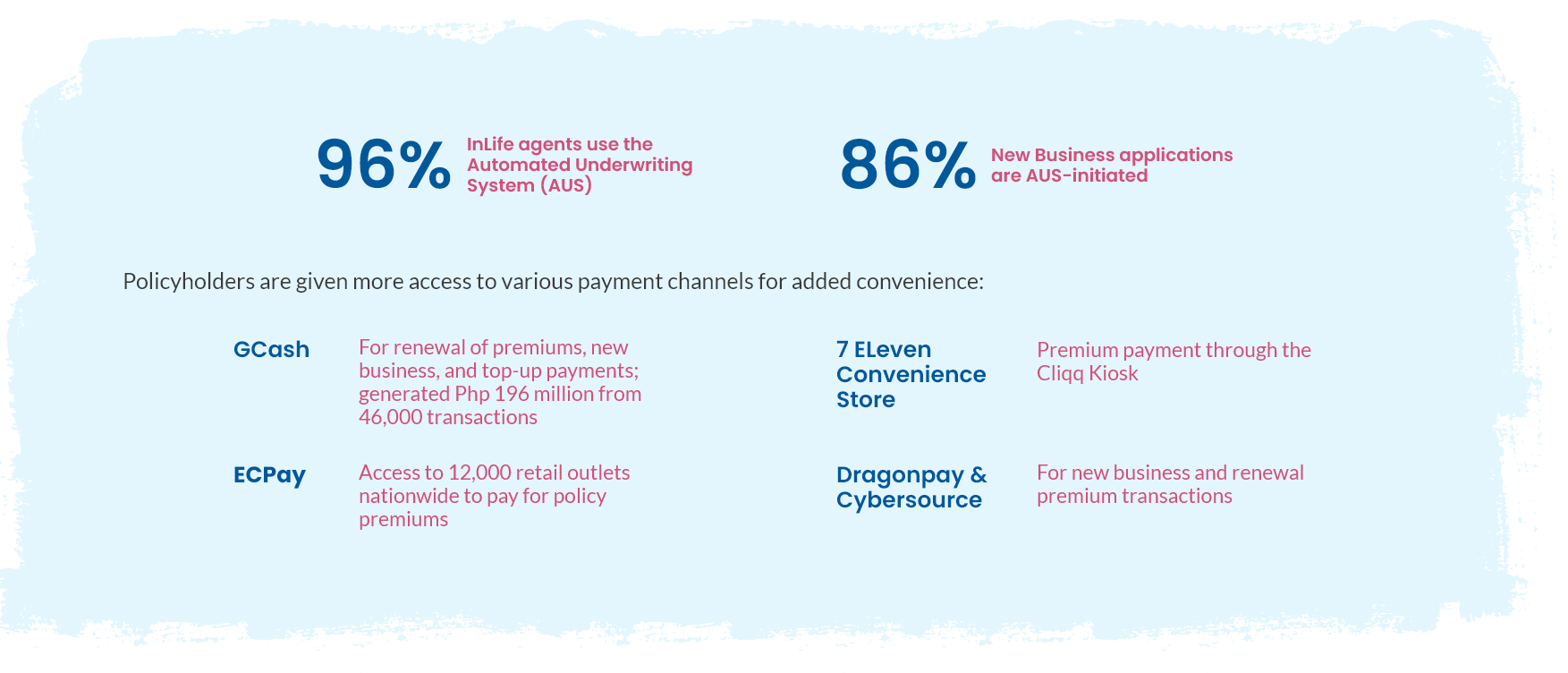

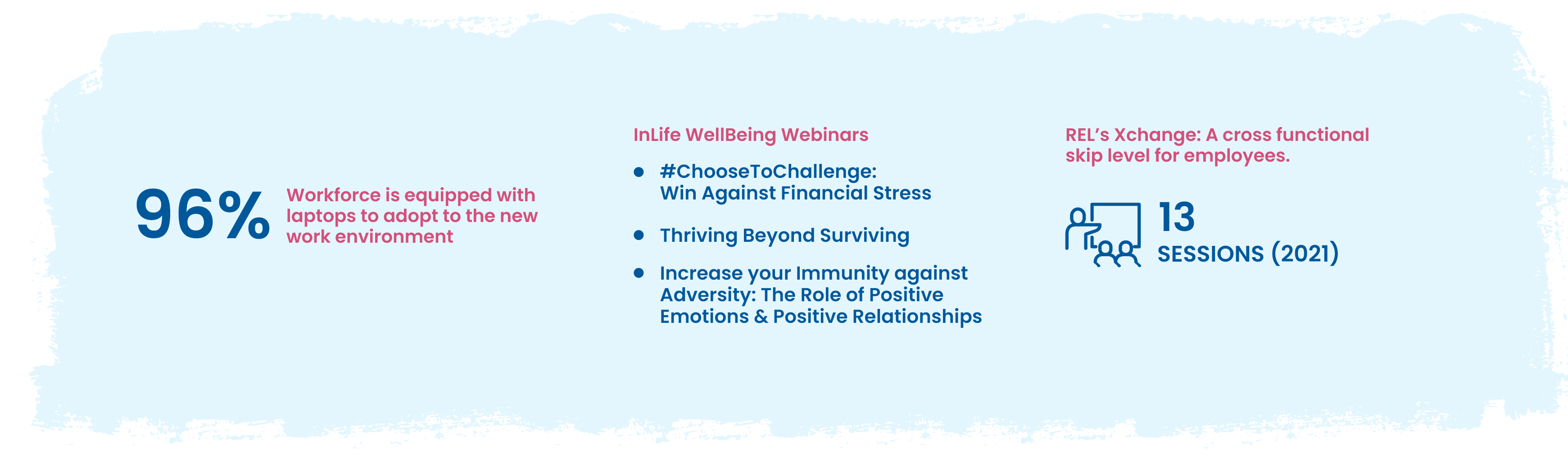

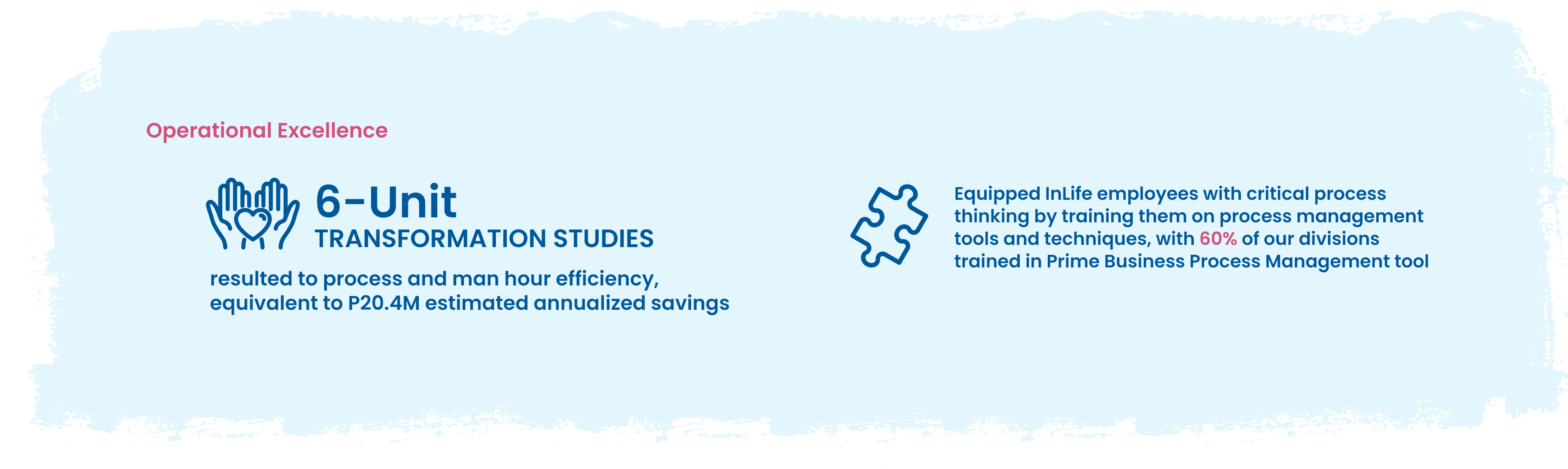

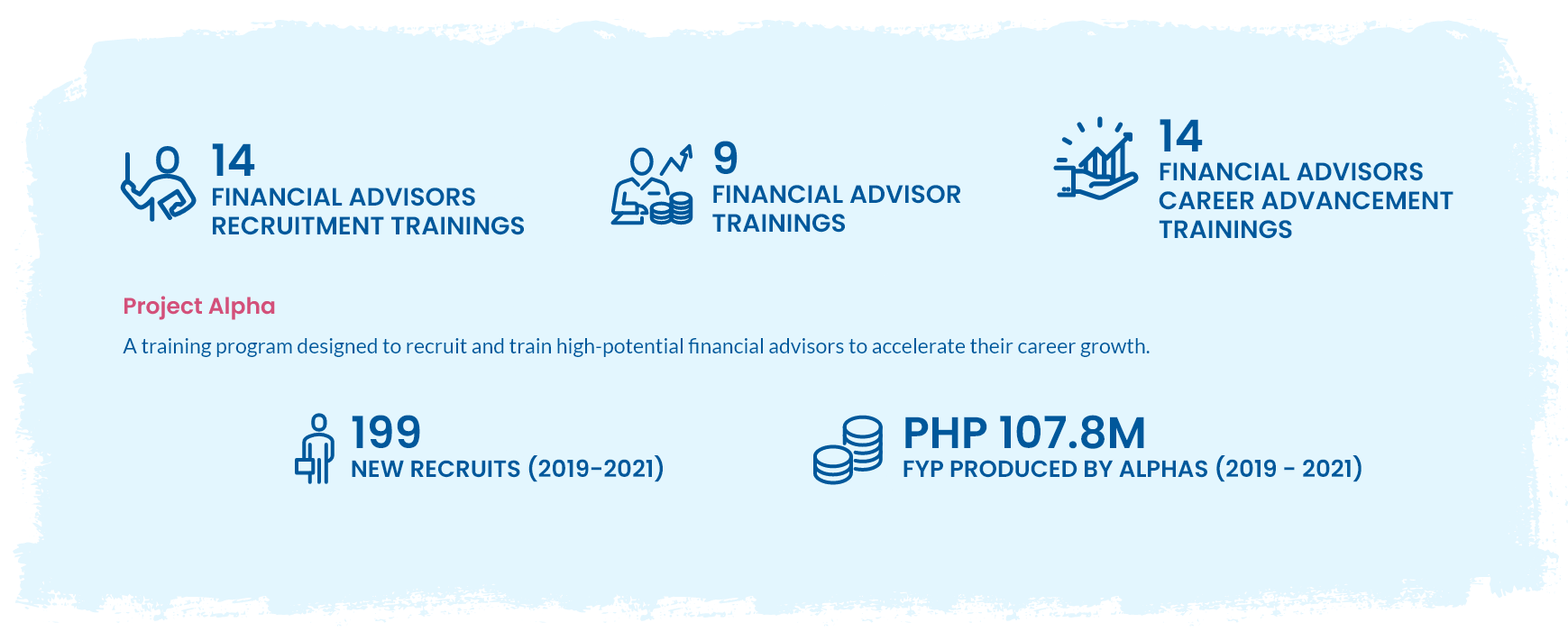

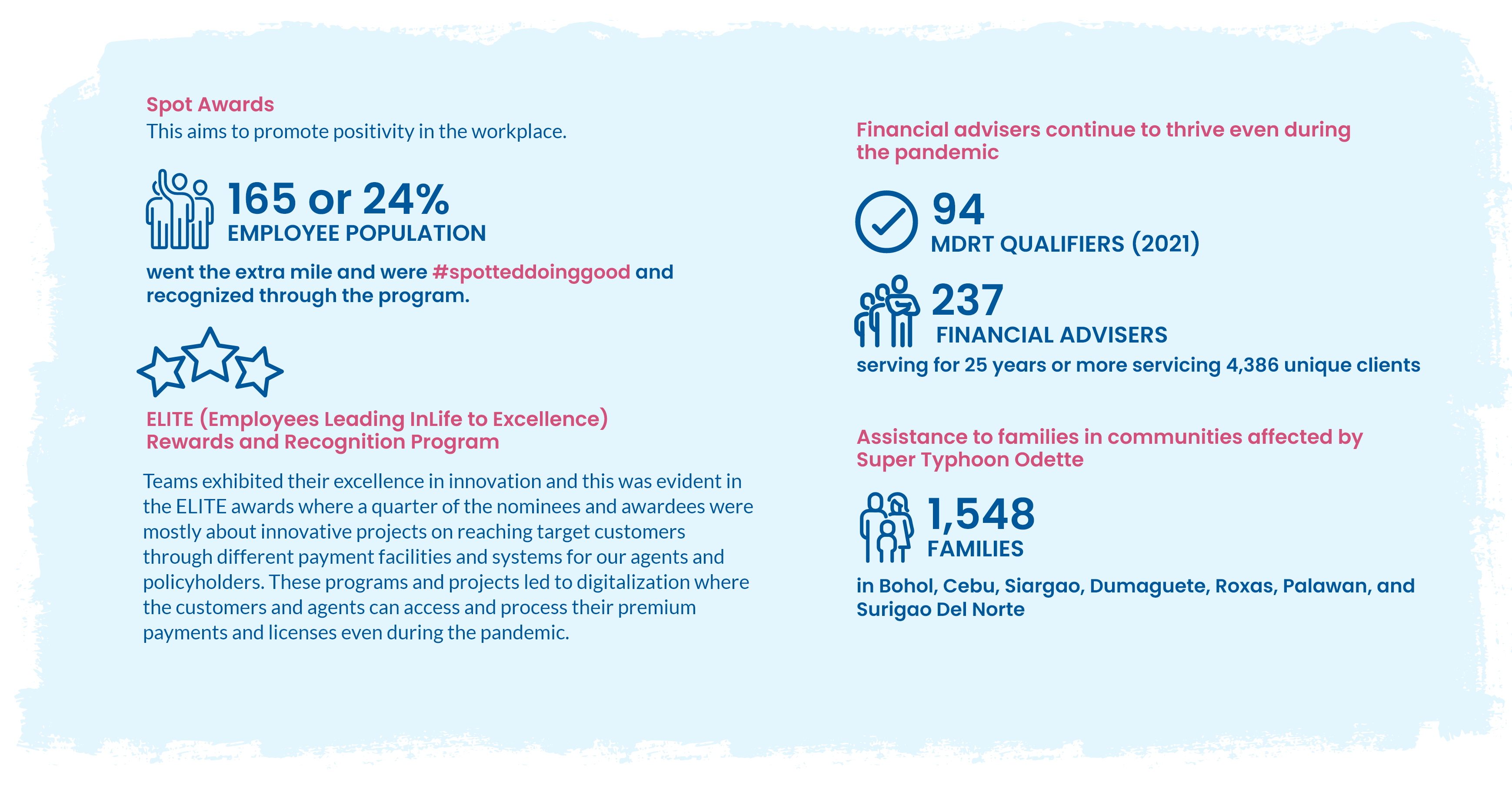

- Turning a Challenging Year into a Banner Year

- Consolidated Financial Highlights

- Special Feature: Humans of InLife

- Q&A With InLife New Leaders

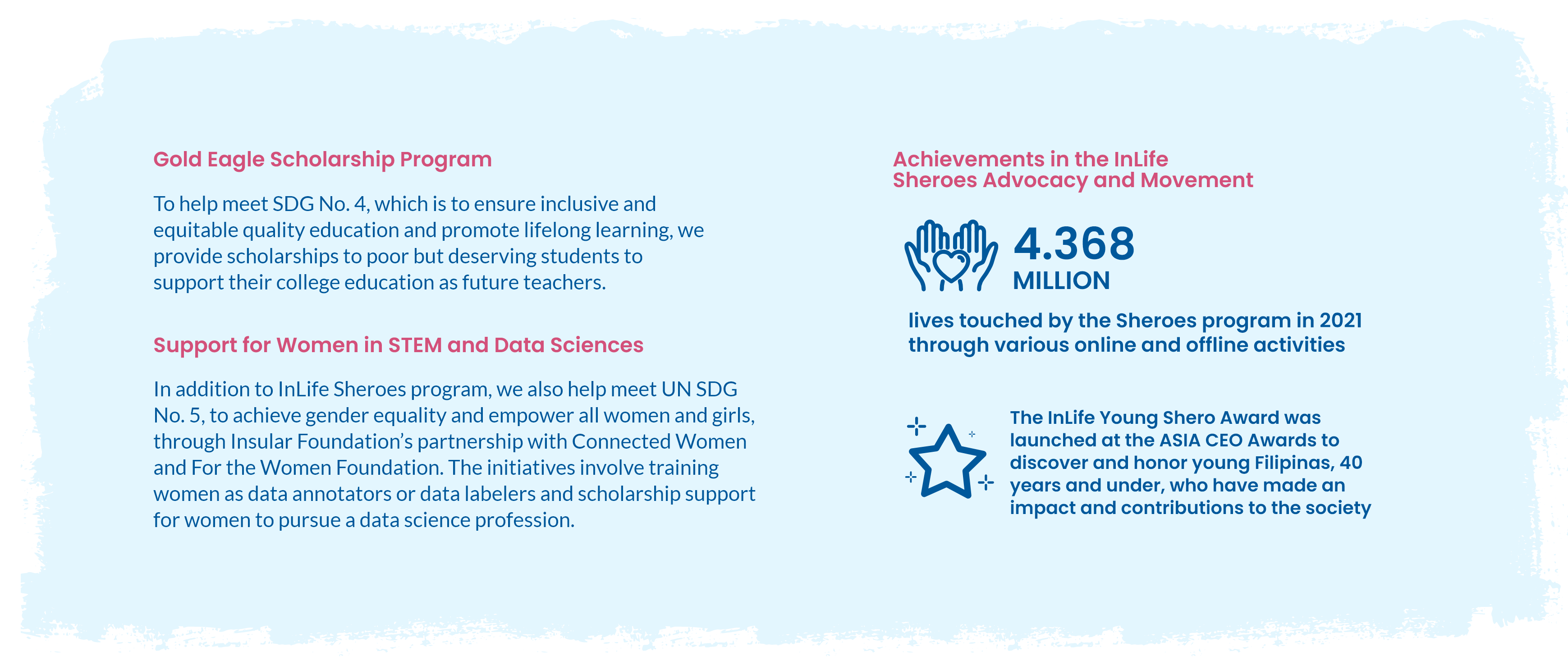

- Empowered Women Empowering Communities

- In the Frontlines of Healthcare

- Doing Good With Grit

- Staying Ageless and ‘Woke’ at 111

- Corporate Governance Report

- Board of Trustees

- Management and Officers

- About the Company

EMERGING

FUTURE

Previous page

Previous page