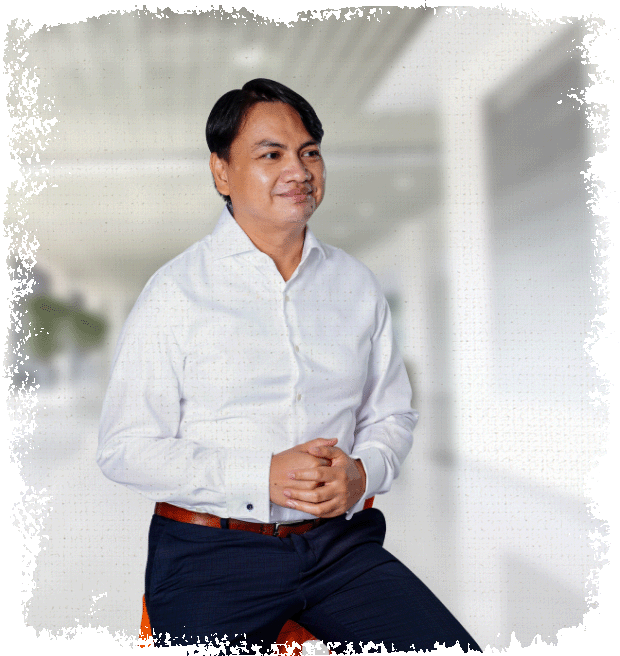

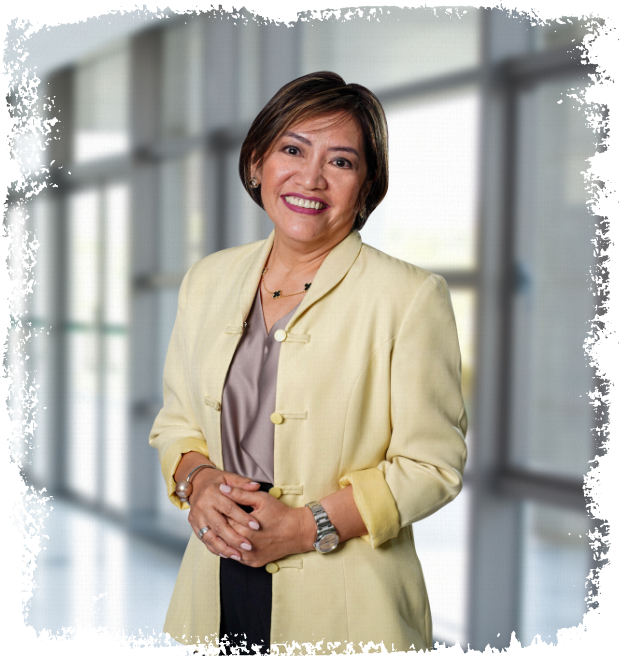

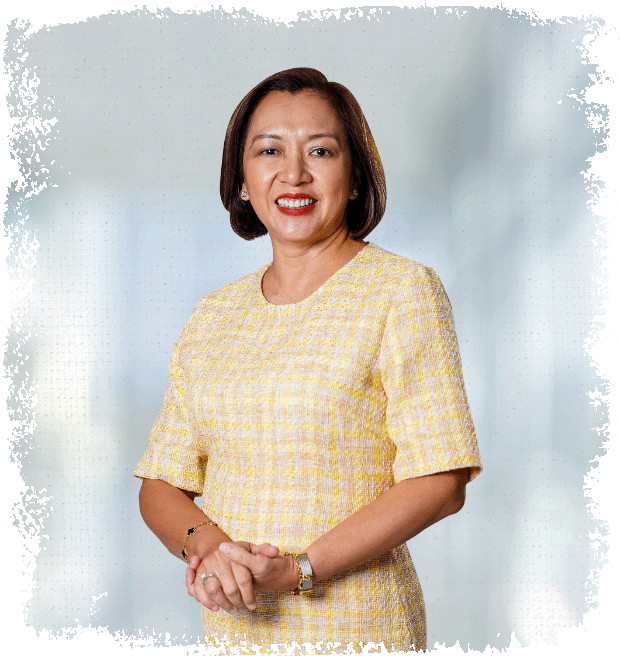

How do you see your new role at InLife?

My experience and core competency is in the area of Operations. My almost 35 years of experience in the field of financial services provide me the skills and understanding on how I can be a team player. I was with Branch Management Division for several years and my exposure with the agency force and responsibilities in Operations allowed me to learn and be more sensitive to the needs of our agents, which made my transition to the new role quite a breeze.

It may not be a direct-selling experience on my part but dealing with the agency force and helping address their needs and concerns have prepared me in this new responsibility. The agency’s expertise in selling combined with my experience in Operations allow all of us to navigate through our day-to-day sales activities. I believe that operating in an environment that is easy, suitable, and accessible is essential in our effort towards growth opportunities and fortifying our business.

What challenges do you see in performing your new role?

Our challenge is managing the new normal as we limit our face-to-face engagement with our customers because of the pandemic. A change in digitalizing our selling and marketing activities was expedited. Our objective is for our agency force to be more effective and professional financial advisors, providing them with added education and training to equip them with the necessary knowhow and skills.

What opportunities do you see in growing InLife?

Companies now are into digital transformation and we don’t want to be left behind. Instead, we want to create a culture of innovation as we examine all aspects of our business for a modern workplace.

And with the radical change we plan to make on the agency side, we see, not just agency growth, but a rebuilding of InLife’s market competitiveness. So to be successful, we also have to build a collaborative culture among other units, address customer pain points, and clear any roadblocks that will develop capabilities centered around the customer experience from the ground up.