After two years of coping with the COVID-19 global pandemic and its lingering effects, we finally saw the light at the end of the tunnel.

While dark clouds continued to hover over the horizon due to rising inflation, supply chain disruption, labor market challenges, declines in asset markets, and extreme weather events, 2022 still turned out to be a good year. The reopening of the Philippine economy and the return of consumer confidence led to pent-up demand, benefiting the insurance industry.

According to the Insurance Commission, the local insurance industry’s combined assets rose in 2022 by 2.14% year-on-year, with the total net worth also rising by 12.35% and premiums climbing by 1.22%.

With more purchasing power and greater awareness on the need for financial preparedness, medical insurance, and risk protection, consumers flocked to life and health protection products, as well as to variable unit-linked products that offer guaranteed income in the longer term

Our Journey to A LifetimeFor Good

Our Response

As always, InLife was ready and well positioned to respond to this heightened consumer demand for financial protection.

To ride on the upswing, we leveraged on our 112 years of experience in insurance and investments, strong digital infrastructure, and customer focused agency force and employees. These enabled us to achieve our two main goals: to acquire more customers and to serve them better.

Our consistent industry standing bears proof of our financial stability and our capability to deliver on our obligations to our policyholders. In 2022, we ranked 2nd in terms of net worth, 3rd in net income and 4th in assets according to the Insurance Commission reports.

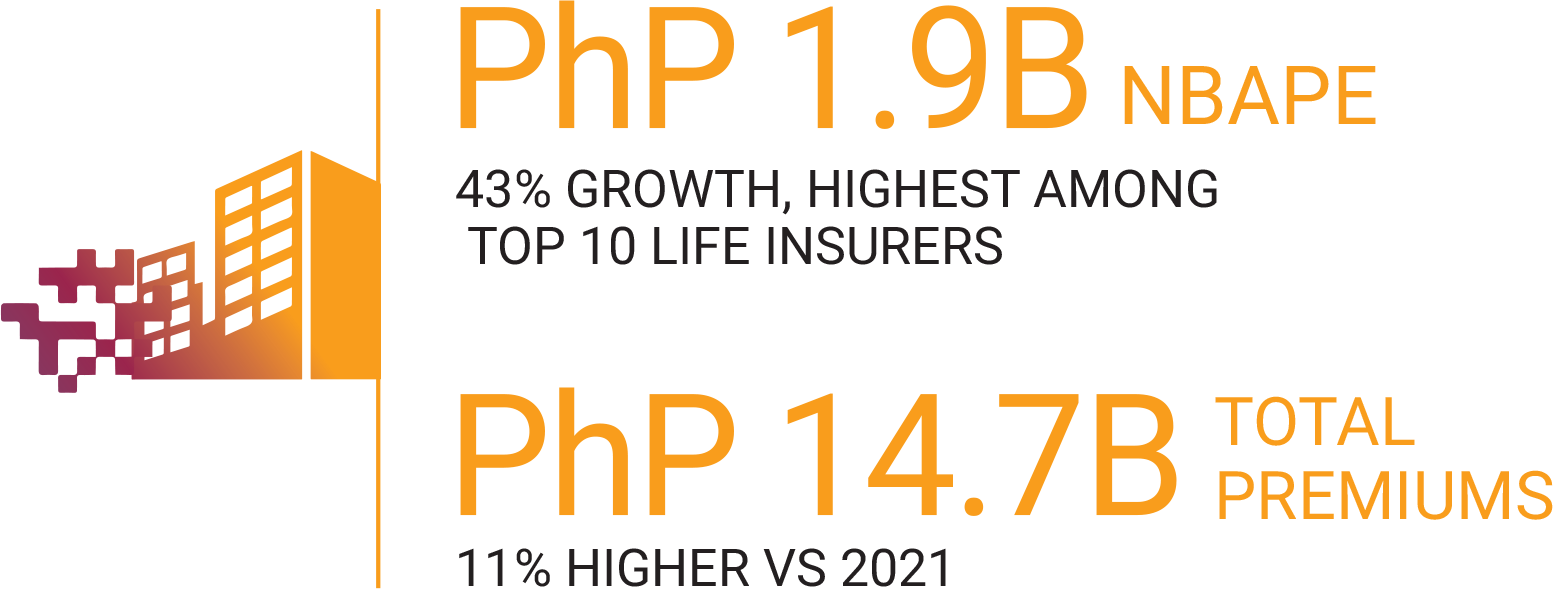

We also made a significant improvement in our sales performance by generating Php 1.9 billion in new business annualized premium equivalent (NBAPE), ranking us 9th in 2022 from 12th in 2021. Among the top 10 life insurers, InLife registered the highest growth rate of 43% in NBAPE. Our total premiums reached Php 14.7 billion, 11% higher versus 2021 levels.

Behind our stellar performance was a cast of thousands who make up our distribution channels (Agency, Bancassurance, and the Group Business). Thanks to their unwavering commitment and dedication, we were able to serve our noble mission of helping Filipinos achieve their financial goals given their heightened awareness on risk protection.

We also catered to the insurance needs of entrepreneurs who needed to realign their employee benefits program and recover from the pandemic-induced business slowdown. Our Group Insurance plans enabled them to extend life insurance coverage to their employees and fund retirement plans.

These partnerships led to the impressive growth of our Group Life business in 2022. New business production amounted to Php 516.4 million while renewals reached Php 1.3 billion, higher by 179% and 29% from 2021 levels, respectively.

Our Most Important Success Metric

While InLife continues to do well based on these industry metrics, we take a different view when it comes to the way we gauge our success. For us, what is paramount is not how much we take from the consumer (i.e., premiums and income), but what we are able to give to our policyholders.

In 2022, we paid a total of Php 790.5 million in claims (death; Minor Beneficiary Fund; and disability, hospitalization, or critical illness) and Php 1.9 billion and $1.8 million in policyholder benefits. While numbers matter, what mattered more is that all these benefits were paid out within our service turnaround standards, which are among the highest in the industry.

Our customers, and not our competitors, make InLife both an enduring and endearing institution. The trust of our customers is our most valuable currency. The insurance products and services we provide help them gain financial freedom and peace of mind. They make them and their loved ones sleep soundly at night. And giving them this kind of assurance — despite life’s many uncertainties — is what drives our purpose.

Customers at the Heart of InLife

We foster a customer-centric culture and mindset to continuously understand our customers who demand clarity, speed, and convenience. This is why customer experience (CX) is at the heart of our operations.

We have a Voice of the Customer Program that focuses on customer listening to provide us with an outside in perspective of our customers. We consistently monitor our customers’ goals, needs, preferences, and expectations so we can craft and implement relevant products and solutions for them.

We track our CX performance using metrics such as the Net Promoter Score, Customer Satisfaction Score, and Customer Effort Score. Beyond scores, customer centricity is our commitment to our policyholders throughout their lifetime.

For us, an insurance plan is not just a product sold in a one-time transaction; it is a long-term investment during our customers’ various life stages — from being new entrants to the workforce, starting their own family and preparing for their children’s education, to saving up for retirement. We listen to our customers’ pulse by gathering their feedback in every touchpoint. We serve them wherever and whenever they want, through our strong digital footprint and nationwide presence. We are able to do all these because of our heavy investments in digital technologies.

Since we pioneered the Automated Underwriting System (AUS) in the industry in 2015, we have been able to provide end-to-end customer service platforms — from insurance selling and policy issuance, to post-sales service. In addition, we have a fully digital insurance selling system (Virtual Business Enabler or ViBE), e-commerce platforms (InLife Solutions, Insular Life LazMall Flagship Store, UnionBank Insurance Marketplace and GCash store), and an array of customer service touchpoints (Customer Portal, InLife Mobile App, InLife Pay, InLife Claims Portal, Facebook Messenger, email, and toll-free telephone numbers). We have digital tools for our agency force (Compass) to ensure that they can effectively serve our customers.

We also continued to implement innovative solutions and launch relevant products with our customers in mind. We launched Wealth Assure Plus, a customizable life insurance plan with investment component that provides higher protection benefit and higher fund growth, as well as ensures that specific needs of the customer are met.

We also offered Secure 7 for a limited time, to give our customers the chance to invest on a life insurance product that offered guaranteed annual payouts of up to 4.5% and capital protection through a return of total premiums after seven years.

In 2022, we rolled out the InLife Agency Model (I AM) that offers our agency force the most rewarding compensation package in the industry and a more flexible agency structure.

We also renovated our offices in Baguio, La Union, Cabanatuan, Lipa, Naga and Mactan to better serve them.

Looking Ahead

While we will continue to keep a steady eye on the customer, we are mindful that 2023 and the coming years will not be devoid of changes and challenges. After all, we live in an increasingly fragile world characterized by rising inflation, global political and economic instability, and the worsening effects of climate change, to name a few.

Closer to home, we see a growing younger demographic that presents both an opportunity as well as a challenge for us at InLife. In three years, close to 80% of our population will be comprised of millennials and younger people. We need to promote financial literacy and raise their awareness on the need for life insurance and health protection. COVID-19 has taught us that there is no better time than now to prepare for the unexpected such as getting sick or losing a loved one.

While life will serve us curve balls, we remain confident in the Filipino — their ability to dream and work hard to make their dreams come true, for themselves and their loved ones. We at InLife share this dream and have made it our promise to deliver “A Lifetime for Good” for all.

As a Filipino company with more than 112 years of expertise in risk protection, we can confidently tell our fellow Filipinos to go ahead and dream again. We are your reliable partner and stand firm with you, now and in your lifetime.