Going Beyond the Bottomline

In the “New Normal” where uncertainties are becoming commonplace, anticipating, planning for, and mitigating risks have never been more critical. These, more so in the case of insurers — considered “society’s risk manager.”

From extreme weather disturbances brought about by climate change, to the social and economic costs of the COVID-19 pandemic and geopolitical tensions, insurers are always on the lookout for potential storms that can cloud the long-term horizon and affect their ability to secure the bright future of individuals and businesses.

As the first and the largest Filipino owned life insurer in the Philippines, InLife believes it is uniquely positioned to shape the transition to a resilient, sustainable, and financially secure economy. Even before “sustainability” has become a buzzword, we have already been integrating environmental, social, and governance (ESG) principles into our boardroom agenda through our operations, within our organization, and the programs of Insular Foundation, our corporate social responsibility (CSR) arm.

Environment: Walking the Talk

Operating in the Philippines, among the world’s most vulnerable countries to climate change, compels us to do our share in helping mitigate the risks of extreme weather disturbances and other effects of global warming.

In 2018, we invested in PhP 1 billion worth of green bonds issued by the International Finance Corporation (IFC), a member of the World Bank Group, the proceeds of which are on-lent to eligible IFC climate projects particularly on renewable power, energy efficiency, sustainable agriculture, green buildings, waste and private sector adaptation to climate change.

In 2022, we intensified our efforts on environmental sustainability and undertook the following initiatives:

- Launched our very own investment fund that supports ESG-focused outcomes with the potential to earn monthly payouts. Our Systematic Global Sustainable Investment Fund (GSIF), the first of its kind in the Philippine market, enables InLife customers to invest in a globally diversified portfolio that promotes ESG values such as companies with lower carbon emissions. Fund manager BlackRock is one of the leading asset managers in the world and one of the leaders in championing ESG’s impact on investments.

- Invested PhP1 billion in the preferred shares of South Luzon Thermal Energy Corporation (SLTEC) to support its pioneering Energy Transition Mechanism (ETM). Investment proceeds will be used in the development of more renewable energy projects with the commitment of decommissioning SLTEC’s coal fired plant and transitioning it to a cleaner technology by 2040. SLTEC’s parent firm, ACEN Corporation, is Ayala Group’s listed energy platform.

These investments are exciting opportunities for InLife, not just as an institutional investor, but also an environmental steward, helping shrink the country’s carbon footprint so we and the generations after us can enjoy a better planet

Fighting Climate Change, One Tree at a Time

They say a bamboo that bends is stronger than the oak that resists. In so many ways, the bamboo is much like InLife: while possessing raw strength, it has the ability to bend and adapt, no matter where the wind blows.

This is also how we at InLife are helping fight a global concern like climate change. Despite the mobility restrictions due to the COVID-19 pandemic in 2019, our Insular Foundation managed to embark on a three-year project called “Kawayanihan: Protecting the Environment and Lives through Community Work and Cooperation” with the Philippine Bamboo Foundation (PBF) and Municipality of Lubao, Pampanga as partner and beneficiary, respectively.

The Foundation adopted 1.8 hectares of the six-hectare Bamboo Hub, the municipal government produced the bamboo seedlings and led the marketing of bamboo products, while PBF provided technical assistance in training the workers and developed bamboo products.

Planting bamboo trees helps reforest denuded lands and provides livelihood opportunities such as handicraft-making for lahar-stricken Lubao.

In 2022, the three-year Kawayanihan project closed, but InLife opened another window. On April 22, 2022, Insular Foundation entered into a partnership with the Ramon Aboitiz Foundation, Inc. (RAFI) to plant 10,000 native tree seedlings in Catmon, Cebu.

The “Growing lnLife: Native Tree Growing Project” aims to recover the tree cover lost and provide income augmentation for partner farmers. As the program implementer, RAFI will conduct technical trainings to assist partner communities to maintain production and growth of the seedlings planted.

To expand this advocacy, Insular Foundation is also encouraging InLifers, agents, as well as residents in the municipality of Catmon to develop deep environmental consciousness, as well as a changed mindset and lifestyle. The foundation continues to promote a sense of tunay na pagbabago at tunay na malasakit (real change and genuine concern) for the environment.

“With the 10,000 trees, we can be a part of the conservation effort that RAFI has been doing in Cebu. We can’t do this alone; we build on what RAFI has started. We are supplementing so that in totality, we don’t look at it as Insular Foundation’s impact, but of course all the organizations that are pitching with their efforts together with RAFI,” said Teresita Melad, program manager of Insular Foundation.

The project will run for 32 months and see project completion by September 2024.

Insular Foundation forges partnership with RAFI for the “Growing lnLife: Native Tree Growing Project

Social: Empowering Our People and Communities

Being an enduring business for 112 years and counting means we need to earn and safeguard the trust of all our stakeholders, including our own employees and the local communities touched by our presence.

Our People, Our Strength

Through changing tides and a raging pandemic, our people have been our critical partner in sustaining our growth as well as in accelerating our policyholders’ and stakeholders’ life journeys. Thus, we go the extra mile to make our InLifers stay, not only service oriented, but also happy, engaged, and thriving in the organization they choose and believe in.

To this end, we mounted the following initiatives in 2022:

| Objectives | Activities/Initiatives | By the Numbers |

|---|---|---|

|

Employee onboarding and retention |

||

|

||

| Celebrating Employee Onboarding activities (3rd year): Quarterly in-person and virtual meeting sessions with our CEO | 44 participants | |

| Promoted the Internal Mobility (Explore InLife) for employee growth and development | 7 positions filled internally | |

|

Employee engagement |

||

| Held Townhall meetings and skip level meetings of the President/CEO with small groups of cross-functional employees (REL’s Xchange). |

|

|

|

Mental Wellness:

|

67 counseling/psychotherapy and psychiatric consultation from June to December 2022 | |

|

106 people managers attended | |

|

379 InLifers (staff to Vice President levels) attended | |

|

Physical Wellbeing and Fitness:

Our Good Squad Ambassadors were the able partners of the Employee Engagement Team in promoting these social activities. |

| Objectives | Activities/Initiatives | By the Numbers |

|---|---|---|

|

Diversity and empowerment |

||

|

||

|

||

|

Rewards and recognition |

||

|

Recognized deserving employees through the following recognition programs:

|

|

|

|

Employees Leading InLife to Excellence (ELITE) Rewards and Recognition program |

Honored:

|

|

|

Promoted employees who were ready to take on next level expanded roles | |

|

Learning and development |

|

Average hours of internal and external training per year:

Staff: 41 hours Average hours of training for the year per employee: 41.6 hours (vs. a target of 40 hours)

Average number of hours spent on external training: Average number of hours spent on our learning management system ILead: 10 hours

Percentage of employees with external training:

Percentage of LOMA* passers: |

|

Total number of FLMI-designation holders: 38 Number of Years that Insular Life has been a recipient of the LOMA Excellence in Education Awards: 18 *Life Office Management Association (LOMA) is the largest trade association supporting the insurance and related financial services industry and used by over 700 member companies around the world. https://www.loma.org/en/about/ |

||

|

Employee volunteerism |

Organized Race for the Extra Mile where participants (employees, agents, and policyholders) generated cash donations based on the total number of kilometers walked, run, or biked during the eight-week challenge. Insular Foundation matched the amount achieved by the race participants for these selected beneficiaries: Department of Education’s Last Mile Schools (LMS) in the province of Rizal and the nonprofit Waves for Water (W4W). |

257 race participants covered 60,704 total kilometers Php 906,500 in total fund matching and donations raised |

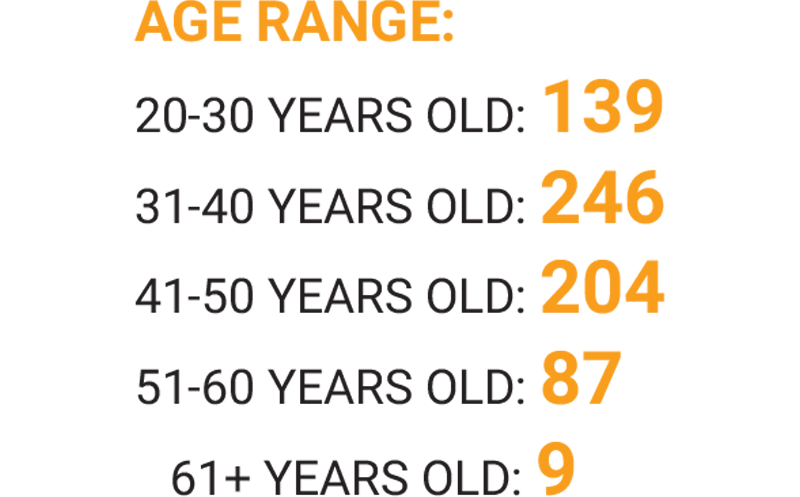

Inlifers by the Numbers

Our Communities, Our Partners in Nation Building

Through the ebb and flow of the nation’s fate and fortune, our Insular Foundation has been steadfast in its mandate to help uplift lives through education for social and economic mobility, women empowerment, disaster relief and response, and sustainability.

Taking a more significant frontline role at InLife than ever before, the Foundation in 2022 strategically mobilized financial, human, intellectual, and other resources to support our corporate social responsibility programs. As mobility restrictions erased, InLife hit the ground running to resume in-person volunteer activities. This translated to some of the biggest donations raised, the highest number of volunteer hours, and record engagement levels in 2022.

The following Foundation initiatives were mounted in 2022:

| Pillar | Activities/Initiatives | By the Numbers |

|---|---|---|

|

Education for Social and Economic Mobility |

||

| Gold Eagle College Scholarship (GECS) Grant |

|

|

| Company Scholarship Program | 22 scholars as of the second semester of AY 2022-23 (15 of whom were in Good Standing) | |

|

Educational support to Alternative Learning System (ALS) in:

|

200 students from Tankulan Alternative Learning System- Community Learning Center (ALS-CLC) in Manolo Fortich, Bukidnon for AY 2022-23 | |

| GECS Alumni Mentorship Program in partnership with Edukasyon.ph |

24 senior-year Gold Eagle scholars were mentored by eight Gold Eagle alumni-scholars from UP Diliman |

|

| Adopt a Scholar Program: on our 5th year of assisting the 3rd batch of our adopted elementary students from four public schools in Muntinlupa and Benguet, who received school supplies with hygiene kits, backpack, school shoes, and uniform for the school year. |

414 Grade 5 and 6 students 81InLife employees adopted one or more scholars |

|

|

Women Inclusion & Empowerment |

||

| InLife Negosyo Challenge (See story: Women Empowerment, From Water to STEM) |

|

|

| Scholarship for Women in Data Science, in collaboration with For the Women (FTW) Foundation (See story: Women Empowerment, From Water to STEM) |

|

|

|

Environmental Sustainability |

||

| Growing In Life: Native Tree Growing: three-year environmental sustainability project in Catmon, Cebu, in partnership with Ramon Aboitiz Foundation. |

|

|

| Kawayanihan Project in Pampanga | 720 bamboos planted in 1.8 hectares of eco forest land inside Lubao Eco Park in Lubao, Pampanga | |

| Philippine Eagle Foundation Corporate Membership |

Sustained support to the Philippine Eagle Foundation (PEF) through the Foundation’s PhP 100,000 corporate membership Aided the emergency relocation of our Philippine Eagle in Malagos, Davao City due to the bird flu outbreak in Magsaysay, Davao del Sur |

|

|

Disaster Relief and Response |

||

|

Emergency Sleeping Quarter Donation |

Donated PhP 1.02 million to Ospital ng Muntinlupa for a 108-square meter emergency sleeping quarters facility for hospital staff |

|

|

Typhoon Odette Assistance:

|

200 families Temporary roofing assistance to 200 households 100 packs of relief assistance Shelter repair materials including GI sheets and plywood distributed to 65 families |

|

| Abra Earthquake Response (in cooperation with the Philippine Rehabilitation and Development Services) |

Food packs for 150 families of Lagangilang, Abra Cash assistance for the shelter repair of damaged homes of weavers through Anthill |

|

|

Employee Volunteerism |

InLife Race for the Extra Mile |

337 InLife employees, financial advisors, agency leaders and policyholders, IHC employees, and Insular Foundation partners participated PhP 900,000 in total cash donation benefiting the Department of Education Rizal’s Last Mile Schools and Waves for Water Philippines |

| Tutor Kita Online Volunteering Tutoring Program (4-month pilot project) |

30 Grade 4 public school students of Bayanan Elementary School Main received a mobile allowance of PhP 300 per month to aid their online tutorial sessions 40 InLife employees signed up and trained for tutoring (26 employees from 12 divisions/ branches completed and finished the pilot run from March to June 2022) |

|

|

Cebu Volunteer Force:

|

43 mothers and their children ages 3 to 12 attended 43 student beneficiaries from Sitio Polton enrolled in K-12 |

Women Empowerment, From Water to STEM

InLife stayed true to its mission of empowering Filipino women through its InLife Sheroes Advocacy and Movement, which entered its fourth year in 2022.

Since it was launched in 2019 as a partnership between InLife and the International Finance Corporation (IFC), a member of the World Bank Group, InLife Sheroes has already reached out to more than 10.8 million Filipinos. This was amidst the continuing challenges of the COVID-19 global pandemic. Thanks to various on-ground and online activities and partnerships with like-minded organizations, Sheroes has served as a vehicle for women to gain access to financial education, health and wellness, womenspecific solutions, and social and business networks. This partnership gained more ground in 2022 with the addition of organizations that promote women’s economic empowerment and equal access to basic services.

Providing Access to Clean Water

Among these partnerships is with Waves for Water (W4W), a nonprofit organization that provides clean water to communities inaccessible by public water systems.

With InLife’s financial assistance, W4W was able to distribute over 30 water filtration systems to help 96 households in Barangay Marungko, Angat, Bulacan.

The filtration systems created a sustainable potable water source for local residents, many of whom were vulnerable to diarrhea, gastroenteritis, and other waterborne illnesses because of clean water scarcity. The turnover of the filtration systems was the culminating activity of the “Nation of Sheroes” program that was launched during InLife Sheroes’ third anniversary celebration in March 2022.

W4W was also able to extend its outreach to various disasterstricken areas using the P450,000 donations raised by the Insular Foundation from the “Race for the Extra Mile” InLife community event in September 2022. From October to December 2022, a total of 114 water filters were deployed to those affected by Typhoon Neneng in Ilocos Norte and Typhoon Paeng in Aklan and Maguindanao, as well as by the shearline-induced floods and landslides in Brooke’s Point, Palawan.

Empowering Women-Led Businesses

InLife Sheroes also marked a milestone in 2022 with the launch of the InLife Negosyo Challenge, in partnership with Insular Foundation and Villgro Philippines, a gender-smart incubator that funds, mentors, and supports impact enterprises.

The InLife Negosyo Challenge was designed to find startup social enterprises whose purpose is to give women and marginalized sectors livelihood and income opportunities.

Four women-led businesses won a total of PhP 2 million in cash grants from the Challenge. The grand winner, which received a cash grant of PhP 1 million, was Panublix Innovations, Inc., a social enterprise that pursues sustainable fashion by connecting designers to regenerative fabrics and artisan crafts.

Empath Corporation, a women-led business that provides online mental health services, was first runner-up and was awarded a P500,000 grant.

HeySuccess Virtual Assistance Services and MAGWAI tied for second runner-up and won a cash grant of PhP 250,000 each. HeySuccess is an enterprise that supports would-be digital professionals and virtual assistants from indigenous peoples communities in Benguet and Baguio City. MAGWAI is a sustainable, marine-friendly personal care product brand.

Creating a Safe Space for Women in STEM

To advance women’s economic development, Insular Foundation sustained its partnership with For the Women (FTW) Foundation to provide a training program that could lead to career opportunities in data science and analytics, a field that suffers from a significant gender gap.

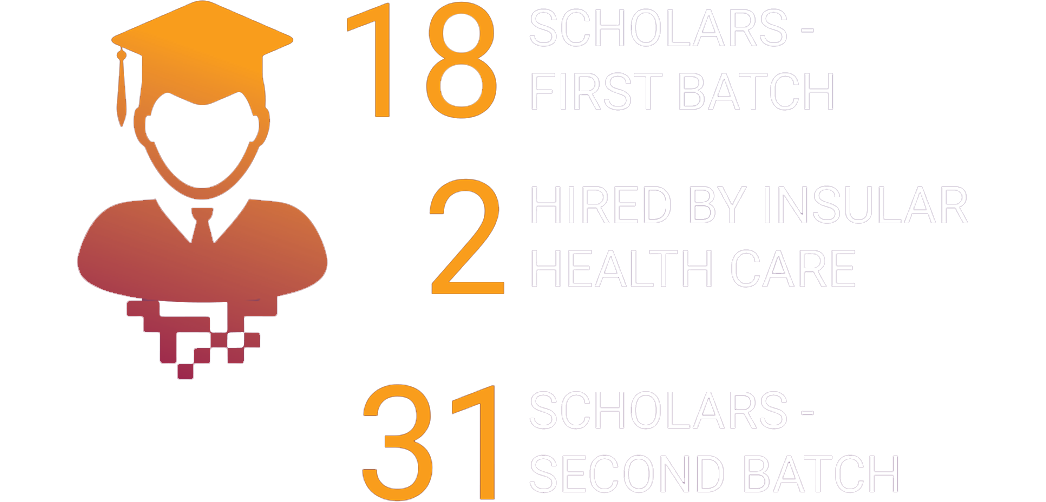

Eighteen scholars comprised the first batch of graduates in 2021, two of whom were hired by Insular Health Care.

On its second year, in 2022, the foundations selected 31 women scholars who started their 14-week intensive training in November. The scholars underwent a thorough vetting process starting September and were among 493 applicants nationwide. The women came from diverse backgrounds: new college graduates, government employees, public school teachers, and InLife employees.

“31 as a number is not statistically significant. But 31 young women, who are better equipped and driven to improve themselves to make conscious choices and better decisions for themselves, their families, their workplaces, their communities — that would create real and meaningful changes,” said Insular Foundation Executive Director Ana Maria Soriano at the graduation ceremonies of the scholars.

Governance: Way of InLife

As a mutual company, InLife is primarily accountable to policyholders. As such, good corporate governance is vital to our sustainable and long-term success and this means being mindful of our reputational and business equities.

While staying resilient and revenue-generating helps our business stay afloat even amidst the turbulent times, we managed to adhere to the highest principles of corporate governance: maintaining transparency and accountability to our stakeholders at all times.

In 2022, InLife was recognized the top-performing company in the life sector by the Institute of Corporate Directors (ICD), in addition to being awarded a Three Golden-Arrow award for the Insurance Sector.

The award, given during the 2022 Annual Golden Arrow Awards for Insurance Companies, was the highest given to life insurance companies. It was also the fourth consecutive year that the ICD has recognized InLife for its good corporate governance practices. The Golden Arrow Award is a highly coveted recognition among Philippine companies for raising the level of compliance with the ASEAN corporate governance principles.

By embedding these environmental, social, and governance principles into what we do, InLife is living its purpose to be a responsible business — earning the trust of our customers and policyholders, employees, regulators, and society at large — ultimately delivering a lifetime for good for all Filipinos.

Why Good Governance Matters to Every Customer

For the fourth year in a row, InLife has been recognized by the Insurance Commission (IC) and the Institute of Corporate Directors (ICD) for its good corporate governance practices. Last year, IC and ICD bestowed the Three Golden-Arrow Award to InLife as it recognized the Company as the Top Performer on good corporate governance for the Life Insurance Sector and for the whole Insurance Industry.

But what does this recognition mean to InLife policyholders and stakeholders?

In this interview, Atty. Renato S. de Jesus, InLife Executive Vice President who is also the Chief Legal and Governance Officer and Corporate Secretary, sheds light on why these principles matter to InLife customers.

How and on what criteria did InLife win this award for consecutive years?

All of them are based on the principles of corporate governance: transparency, accountability, fairness, independence, and more. These principles are broken down into several sub-principles, such as taking care of your shareholders. And then there are standards for each, where you have to comply. In most of the areas, we got the highest score.

What do you think needs to be improved?

Good governance is always a continuing journey at InLife. We don’t just comply with the standards; we always aim for the best practices. If we cannot do the best practice ourselves, we look for jurisdictions that know better and try to emulate them. If they’re applicable to our organization, by all means we adopt their standards.

But these are principles or practices really; the more important thing is to really focus on who our stakeholders are and what they need. We do everything to protect and benefit them — this is the real essence of governance. It’s not lip service. It’s providing things they really need.

Let’s talk about customer centricity. How does corporate governance benefit InLife customers?

Life insurance is a business of trust. It’s inherent to InLife as an organization to ensure that the needs of our customers are provided, and the needs of our stakeholders are addressed and served. We can say we are here for them: that’s the basic principle and the mindset. We deliver value.

InLife isn’t just like other insurance corporations, which are stock corporations. In our case, we are a mutual company — we don’t have stockholders but instead have members. Our members are the policyholders themselves, and the reason they are with us is they want to be protected and get good returns from their investments. That’s what we are focusing on: what is valuable to them, and the commitment and promise to provide them with the policyholder service they need. All of this is to protect their interest as primary stakeholder.

Corporate governance is often seen as an offshoot of the heightened demand from consumers to hold companies accountable. Is that a prevalent concept here in the Philippines?

It all started because of the financial and corporate scandals in the United States. The bad players knew the reason: there was no transparency.

In our case, when InLife was starting with all these practices, the competition was always focused on sales. Eventually there was a shift to the customer perspective, highlighting the need for excellent customer service.

Apart from sales and service, there’s also corporate governance and doing the right things so people trust you. Because of the nature of the business, if people trust you, they will buy from you and sales will naturally follow. That was our concept when we were trying to sell the concept of corporate governance. It’s a combination of regulatory requirements and the organizational drive.

How is adherence to good corporate governance principles cascaded down the line in the organization?

As I said, it’s a journey. We started many years ago even before corporate governance became a regulatory requirement or a buzzword because of the very essence of our organization: we have a lot of members, our policyholders. The objective was to have good corporate governance as a culture, a second nature or a way of life. So it has to be ingrained in the minds of all the members of our organization — from the Board of Trustees down to our employees.

Admittedly, it was a bit of a struggle at first to do this. In anything you do, you have to advocate. At the start, there was some form of resistance, as people were used to the traditional way of just doing the work they are expected to do. Focusing on the customer or policyholder has to be imbibed by everyone, and when that’s done, they would know the rationale behind these requirements or practices. We had to introduce corporate governance slowly but surely. Eventually, employees became advocates themselves and from there it has always been part of their decision-making.

Governance isn’t just a function of one unit in the company. It’s a shared responsibility by everyone. We all have a valuable role in committing and adhering to corporate governance principles.

How did your digital transformation improve your corporate governance practices?

Digitalization fast-tracked everything. As you know, corporate governance has to rely on effective communication, sharing of ideas, and listening to stakeholders. Going digital improved all of that.

In our corporate website, we publish all our company disclosures to show transparency and financial soundness. Our policyholders get real-time information on their own records via our Customer Portal. Now there are protection policies with investment built into them, so there are things to be updated every so often depending on the performance of the market. We provide that facility in our InLife app so policyholders don’t have to go to the office or call their agent to do the transaction. They can transact within the comfort of their own home or wherever they go, whenever they want to.

Digitalization also helps in effective communication, as we can easily update policyholders even regarding our corporate social responsibility (CSR) activities. It’s about building an InLife community and enhancing our partnership with members so they become active participants in the business. It’s InLife on demand, as they need it.

What challenges do you see in improving your corporate governance practices?

We have to maintain the spirit and keep the fire burning. Fortunately, we have put structures in place to ensure these principles stay alive in the organization, of course as guided by our regulators. We have a very strong, independent-minded Board of Trustees as well as governance committees tasked to oversee the continuing corporate governance practices in the company. The senior management, too, is very conscious of these principles.

There are challenges but we make sure continuing implementation won’t be a problem. We’d like to listen more — and for us, that’s the most important thing.

Governance isn’t just a function of one unit in the company. It’s a shared responsibility by everyone. We all have a valuable role in committing and adhering to corporate governance principles.